In an environment filled with advances in technology and innovations, how we manage our finances has evolved tremendously, too. The arduous eras of queuing up in long lines (of which some were in banks) or burning the midnight oil and writing the checks that helped to pay bills and money send are now ancient history.

The era of ease and convenience is the new era of payment apps. Bill payment through these assorted tools run by Unified Payments Interface (UPI) now is a breath of fresh air. From packed with an array of functionalities and features, a money sending app is developed to make managing your finances easy as you use the app. Thanks to just a finger touch, an enhanced user experience awaits.

Convergence of UPI and Credit Card

The main ambiguity aspect in which new age apps help in price simplification is the use of a single platform as a connection between UPI and credit card bill payments. The users do not need to play the drama of opening different apps and viewing sites to make varied payments since they can access all the payment needs in one place. Whether it is UPI-based services for making payments or setting up automatic bill payments for credit card bills, a money send app provides a unified experience that can facilitate convenience for customers. The time and effort they require will be reduced.

User-Friendly Interface

As new-age payment apps are user-focused applications, they make their interfaces simple and easily accessible, making navigation and operation comfortable. They range from the simplest one-tap payments to simple dashboards that broadcast a wide variety of personalized transactions. A money sender app is suitable for all age groups and people irrespective of their background.

Convenience and Accessibility

The number one advantage of modern money apps is that they help to make things easy in terms of access and convenience. Customers can make payments wherever and whenever they want with their smartphones or any internet device. Rather than going to a financial institution, you can access your accounts in a matter of seconds from any location in the world with your mobile phone. Nowadays, with the level of convenience they are experiencing, people can handle their finances in ways they have never seen before, and it is convenient for them to keep anything from bills to expenses in check.

Security and Privacy

Security is the priority for payment software solutions of the new time, and encryption methods and authentication systems of strong extraction are used to protect user’s confidential data. You can be confident in the security of your funds transfer and bill payments since you are assured of their safety and security. On top of that, these apps usually provide features that include the use of biometric authentication and two-factor authentication to give extra protection to protect users against unauthorized access.

Automation and Reminders

The next feature is simplicity. Recurring payments for bills can be set up, which allows for payments to occur every month at scheduled intervals without human intervention. Likewise, such applications usually provide reminders and notifications to inform users of upcoming dates or insufficient balances, thereby keeping them up-to-date and away from incurring late fees or penalty charges.

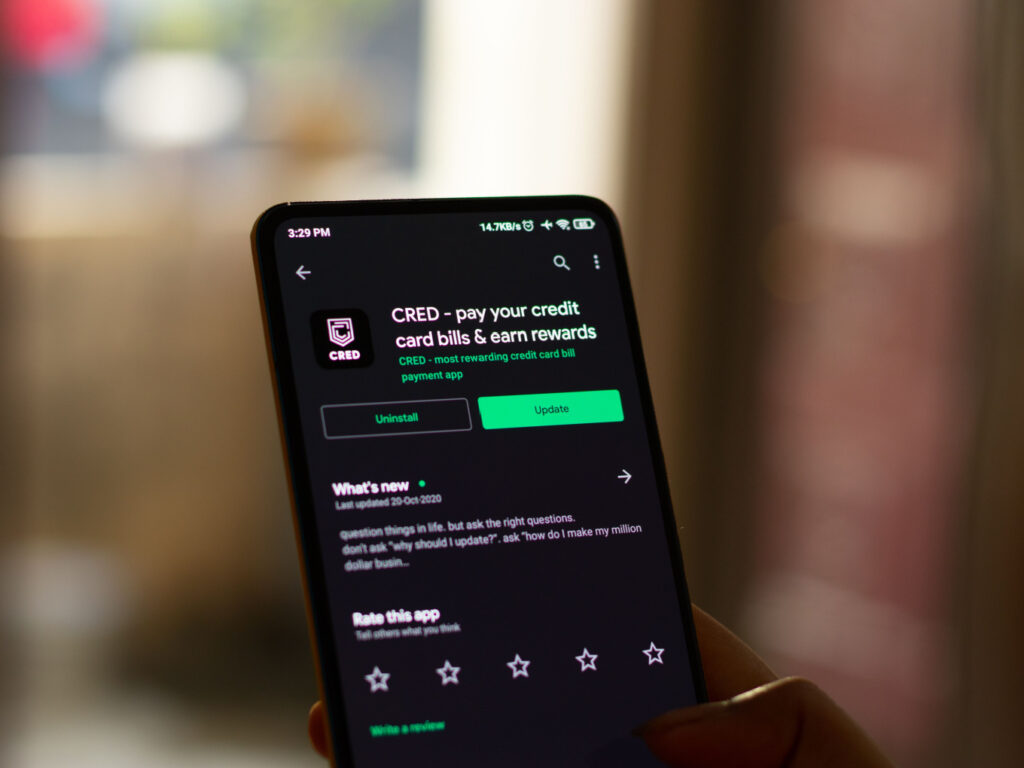

Rewards and Incentives

Many new-age payment apps offer rewards and incentives to encourage users to make payments through their platform. Whether it’s cashback on UPI transactions or rewards points for credit card bill payments, these apps offer a variety of perks that can help users save money and maximize their spending. By leveraging these rewards and incentives, users can make the most of their payments and stretch their budgets further.

In conclusion, new-age payment apps have revolutionized the way we handle UPI and credit card bill payments. With features such as integration, user-friendly interfaces, convenience, security, automation, and rewards, these apps offer a comprehensive solution for managing finances in the digital age. Whether you’re looking to simplify your payments, save time and effort, or maximize your rewards, new-age payment apps provide the tools and functionalities you need to stay on top of your finances and achieve your financial goals.